Menu

Planners trusted by over 8,000 wealth-builders around the world

Prioritize your goals

Multi-task your money

Remain exceptionally organized in under 2 hours per month

Reveal the “extra” in your budget that can be put towards freedom AND fulfillment

Choose between 2 designs and 2 binding options

Drop all of your monthly/weekly bills, irregular bills, variable spending estimates, income details, automatic saving/investing on 1 setup tab and enjoy…

Check out the FAQs below for specific breakdowns of what the setup tab can handle!

The planner and Google Sheet instructional videos are divided into 2 “courses” and are completely FREE. They are page/tab specific, so you can quickly navigate to where you need additional guidance.

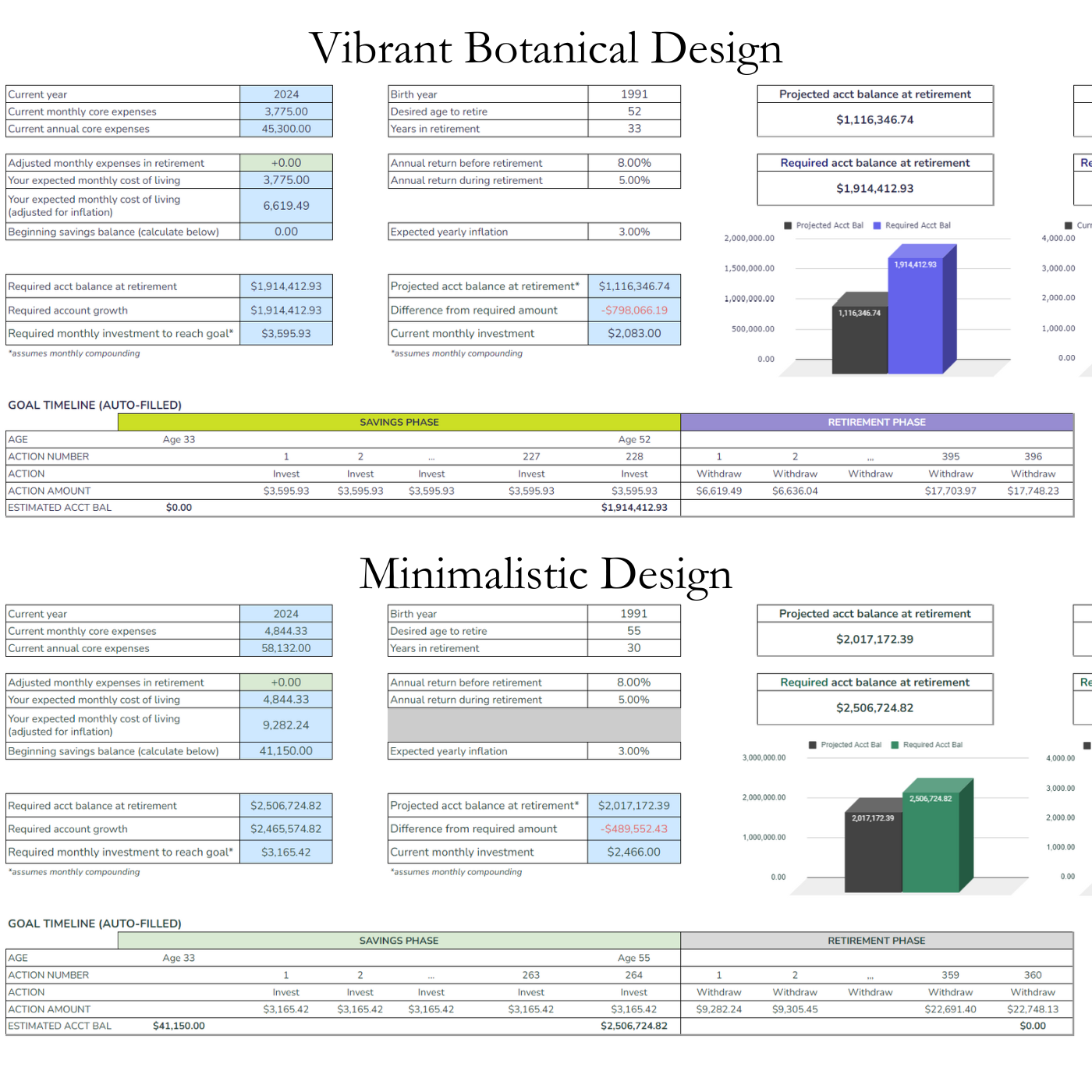

The Mosaic Wealth Planner for Google Sheets features a retirement planning tab that creates a visual timeline of your roadmap to retirement, taking into account inflation, expected returns, and anticipated spending.

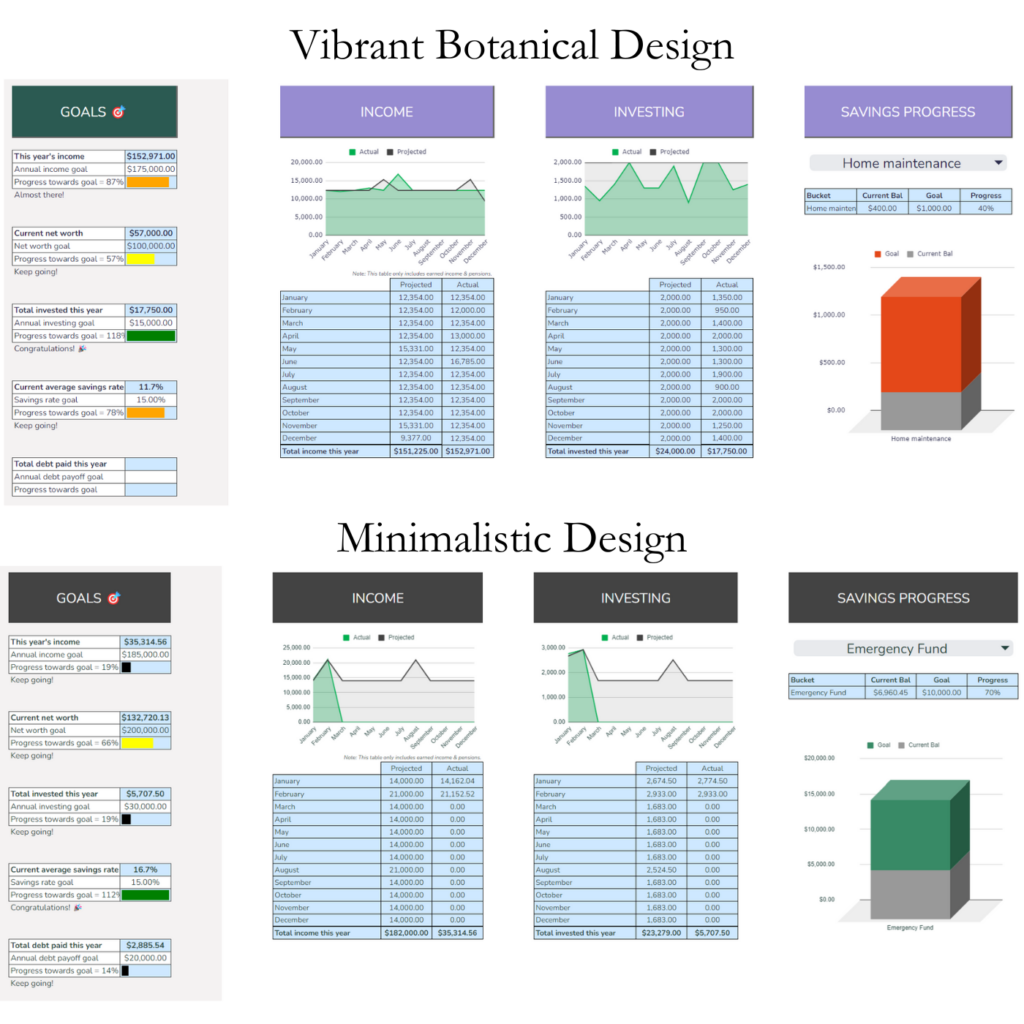

Enjoy auto-generated charts and summaries for all areas of your finances: income, investing, saving, debt payoff, fixed expenses, variable expenses, monthly spending breakdowns, and more!

If after 30 days, you are not satisfied with the Mosaic Wealth Planning system, we will issue you a full refund.

Simply email support@raemichelleplanners.com with a screenshot of your setup tabs/pages, and we’ll return your original investment.

When I set out to change my financial tide in 2016 following a costly divorce and years of careless spending, I struggled to find a system or template that was right for me.

I didn’t want to stop living while I was getting out of debt.

I didn’t want to narrow my money management down to only “wants” and “needs.”

I needed something durable and structured – a template that would allow me to live MY definition of a fulfilling life AND set me up for financial success in the future.

I couldn’t find it. So I built it.

The 8-Part Budget™ is at the heart of the Mosaic Wealth Planning system. It’s a checklist-style approach to personal/family finance that cuts out the guesswork.

It’s the same framework I used to pay off $74K of debt, cash-flow a dream wedding and honeymoon to the tune of $41K, invest $100K and even establish a four-figure college fund for our children, all in four years’ time.

Now I teach the 8PB to women and couples all around the world.

I want YOU to experience the magic, too!

Here’s to becoming HAPPY millionaires.

You’ll receive your digital download Google Sheet within 3-5 minutes of placing your order.

Planners ship within 2 business days from Lindon, UT.

Yes!

Please note that import duties, taxes, and/or other charges are not included in the shipping price. You should consult with your customs office for details on such prices.

The setup designed is designed to handle UP TO:

— 25 budget categories (housing, transportation, dining out, etc.)

— 93 monthly bills

— 6 weekly bills (e.g. lawn care due every Thursday)

— 10 variable expense line items (dining, groceries, pet costs, fuel/tolls, etc.)

— 20 non-monthly bills (e.g. Amazon Prime due every Dec)

— 1 automatic emergency fund savings entry on a per-paycheck basis

— 4 additional automatic savings lines on a per-paycheck basis

— 5 automatic investing lines on a per-paycheck basis

— 3 automatic family investing lines (e.g. 529 contribution every paycheck)

— 2 automatic giving lines on a per-paycheck basis

— 15 debts

— 1 bi-weekly mortgage payment

— 3 additional income lines (can be monthly, semi-monthly, bi-weekly or weekly)

At this time, the Mosaic Wealth Planner for Google Sheets only supports monthly, semi-monthly and bi-weekly budgeting.

However, due to community feedback, weekly budgeting is expected to be included in the next release (anticipated launch: fall 2025).

Due to heavy automation and high integration between tabs, it’s extremely helpful to be comfortable with spreadsheets prior to using the Google Sheet.

The template is powered by over 1,000 formulas and may seem overwhelming to a Google Sheet-beginner.

If you are rather new to digital products of this type, rest assured that the tutorial videos break down every component step by step, and our support team is a message away if you have any questions.

Definitely. Whether you budget alone, with another person or as a household, the Mosaic Wealth Planning system helps you organize your finances and reach your money goals.

An income of $100,000/year or more is certainly not a requirement to use the Mosaic Wealth Planner.

The framework was designed to help those who have discretionary dollars (“extra money”) every paycheck that they aren’t sure how to direct. Discretionary income is typically associated with higher incomes, but we recognize that isn’t always the case.

Bottom line – if you know you could benefit from organization and structure when creating a spend plan, the Mosaic Wealth Planner is an exceptional resource.

We do not issue exchanges for Mosaic Wealth Planner products.

Please reach out to support@raemichelleplanners.com to share your experience, and we will do our best to make things right.

Hardcover Mosaic Wealth Planners are undated, so you are free to start whenever you’d like!

The Google Sheet prompts you to select which year you’ll be using the template for, so the auto-generated charts and summaries are most helpful with a full year of data.

However, you can always budget for a partial year with the spreadsheet and download a fresh copy at year-end to start fresh. One purchase = unlimited downloads!

Please send an email to support@raemichelleplanners.com and we’ll be in touch within 48 hours.

Copyright © 2024 RMR Creative, LLC. All Rights Reserved. Site Powered by Pix & Hue.